Healthcare Reform for Large Employers

Gallaher Insurance Group

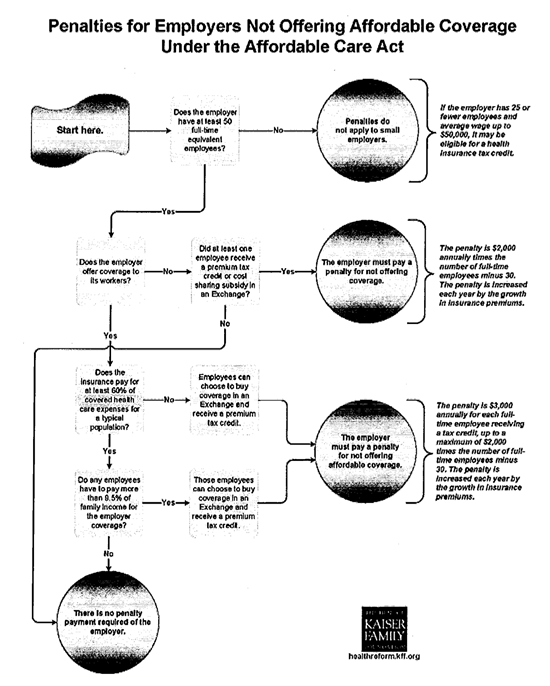

The Affordable Care Act requires businesses with 50 or more employees to provide health insurance benefits to their workers. Originally scheduled for 1-1-14, this provision was delayed until1-1 15. See the next page for a flowchart illustrating the process and penalties for non compliance.

Updated: July 15, 2013.

Large Employers have three options for health insurance in 2014.

- Offer health insurance that meets the minimum coverage and is affordable. (Minimum coverage is any medical insurance coverage that does not limit coverage to specific benefits such as dental or vision only. This includes major medical (or catastrophic) plans.

- Offer some level of coverage that does not meet minimum requirements and pay the employer penalty.

- Stop offering coverage, let employees buy through the individual market exchange and pay the employer penalty.

Penalties for large group employers:

If minimum coverage is not offered to full-time employees, and at least one employee gets subsidized coverage through an exchange, then a$2,000 penalty is assessed for each full-time employee (after the first 30).

If minimum coverage is offered to full-time employees but it is not affordable for an employee, and that employee gets subsidized coverage through an exchange, then a $3,000 penalty is assessed for each full-time employee getting subsidized coverage.

Health care reform does NOT require employers to contribute to the premium. (Although if they do not, their plan may not be affordable, putting the employer at risk for penalties.)

The professionals at Gallaher Insurance Group can help you along with your decisions on employee benefits. We understand there are a number of choices that you have. We will work together to find the best solutions. Our staff has been certified and trained with the Affordable Care Act (Obamacare).